Women in Tax: A Force for Change in Africa

In interviews with women in tax across Africa, the issue of women’s representation highlighted the critical role of tax as a development tool.

Women are playing an increasingly important role in tax administration in Africa. They are bringing new perspectives and skills to the table, and they are helping to make tax systems fairer and more equitable.

In interviews with women in tax across Africa, the issue of women’s representation highlighted the critical role of tax as a development tool.

Regina Chinamasa, the Commissioner General for the Zimbabwe Revenue Authority, said women are essential to the success of tax reform in Africa.

"Taxation plays a critical role in nation-building, and you need women and men that are committed to mobilise resources and be the catalyst in the social contract implementation. I see it as something that keeps me awake, always asking if I can do more for better service delivery in our countries.”

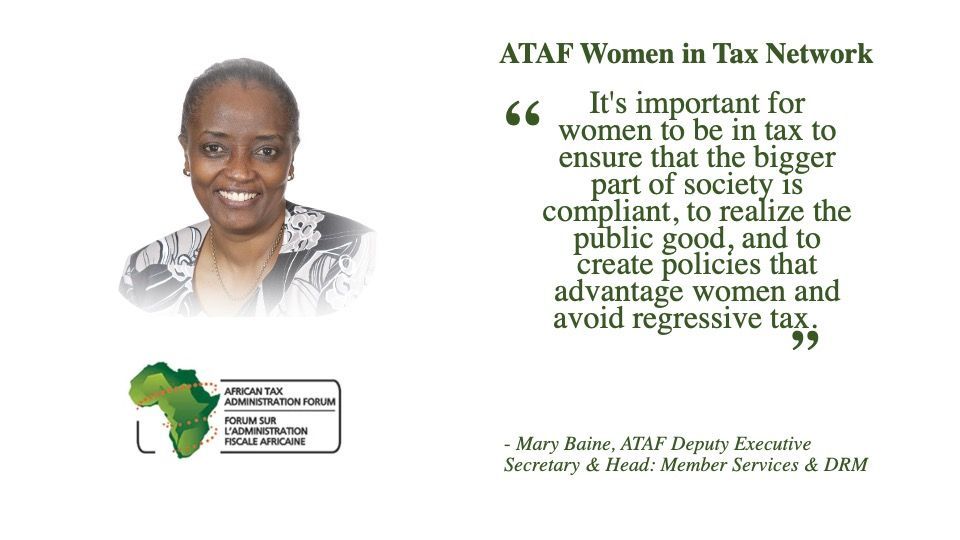

Mary Baine, the Deputy Executive Secretary of the African Tax Administration Forum (ATAF), agreed. "It's important for women to be in tax to ensure that the bigger part of society is compliant, to realise the public good, and to create policies that advantage women and avoid regressive tax.”

This view was shared by Veronique Herminie, a tax advisor and former Commissioner General for the Seychelles Revenue Commission, who said:” There is a need for more women with the right qualifications and experience to be employed by tax administrations at decision-making level to reduce gender bias. Men seem to be overrepresented especially at management levels.”

Chenai Mukumba, the Executive Director of Tax Justice Network Africa, said she enjoyed working in tax because it is an important lever to contribute to the functioning of economies. "Tax permeates every single aspect of our lives," she said. "It is an important tool for development, and women have a unique perspective to offer on how tax can be used to promote equity and inclusion."

Celeste Banze, Tax Policy Advisor for the Ministry of Economy & Finance in Mozambique, encouraged other women to get involved in tax because it is a way to make a difference in the world. "Tax is about development," she said. "It is about ways of opportunities. Tax is about well-being. Tax is the source of everything in a country."

Varsha Singh, the Head of Planning, Strategy, and International Cooperation at the Africa Tax Administration Forum, said that she believes that women can make a difference in tax administration by bringing a different perspective to the table. "Women are often more collaborative and inclusive. "They are also more likely to be aware of the needs of marginalised groups,” said Singh whose career in tax spans almost three decades.

Herminie said she was proud to be a woman in tax: "The importance of taxes is the same everywhere - raising revenue for Government functions and projects.

“A tax administration is the framework to enable and facilitate tax collection as well as guide the implementation of tax policies. It is an important function and in Seychelles for example over 80% of revenue collected by the Government is through taxes,” said Herminie.

Baine, who began her career in tax in 1994 when she joined the Customs Department in Rwanda, said she stayed in tax because she saw the wider purpose: “Tax is a key enabler of development, allowing our country to recover from the genocide and its effects, and build a better life for our citizens."

“I encourage women to enter this field,” said Singh. “Tax has evolved since I first entered, but not significantly enough. We still need more women in technical areas of tax and policy development. Women can make a difference by bringing diverse perspectives.”

Singh said having more women at the table would help move tax authorities to a more gendered approach in tax policies.

"I would encourage women to be involved in tax administration because it's a male-dominated space, and more women means more varied and diverse voices contributing to the formulation of tax policy," Mukumba explained, asserting that women bring "a much-needed and different perspective to the work."

Highlighting the critical role mentoring plays in ensuring more women at the table, Chinamasa said: “I've been mentored, and mentorship has played a critical role in ensuring that I build on my technical expertise. As I grew in the system, I've had mentors who allowed me to grow to be where I am, and I really appreciate that.”

As part of that journalist, Chinamasa also enabled mentorship for other women by starting a Women in Tax forum in Zimbabwe.

Baine said it was important for women to stay in tax. Her leadership advice? “Know what you want, understand your purpose and how you want to get there,” said Baine.

Singh concurred: “I've learned to believe in what I know and to speak up. Women should make themselves heard and support each other. Women should mentor other women and take chances when opportunities arise. Supporting women re-entering the workforce is vital, and being confident is key to success."

When asked about her leadership journey, Chinamasa shared valuable lessons for women in tax, stating, "I think for me what has been important is having self-drive, ambition, and focus on results.”

Sharing her leadership journey, Herminie encouraged inclusiveness, listening, guidance, and firmness. Reflecting on her 33-year career, she attributed her success to gradual progression, mentoring, and continuous learning.

“I've had good mentors along the way, and I will eternally be grateful for the lessons learnt, which has made me into the person I am today,” she said.