Significant progress made in fighting tax evasion and illicit financial flows in Africa, but further efforts needed to support domestic revenue mobilization

African Tax Administration Forum • June 25, 2020

25/06/2020 – Tax Transparency in Africa 2020, launched today as part of the Africa Initiative, depicts the state of play for 32 African Union Member States, members of the Initiative and three non-members. It shows the progress achieved on the two cornerstones of the Initiative: (i) raising political awareness and commitment, and (ii) developing capacities in tax transparency and exchange of information (EOI). Tax transparency and EOI have a crucial role to play in helping African governments stem illicit financial flows (IFFs) and increase domestic revenue mobilisation.

"The ongoing COVID-19 crisis will completely end any tolerance towards all forms of tax evasion,” said Maria José Garde, Chair of the Global Forum on Transparency and Exchange of Information for Tax Purposes.

Main findings from the report

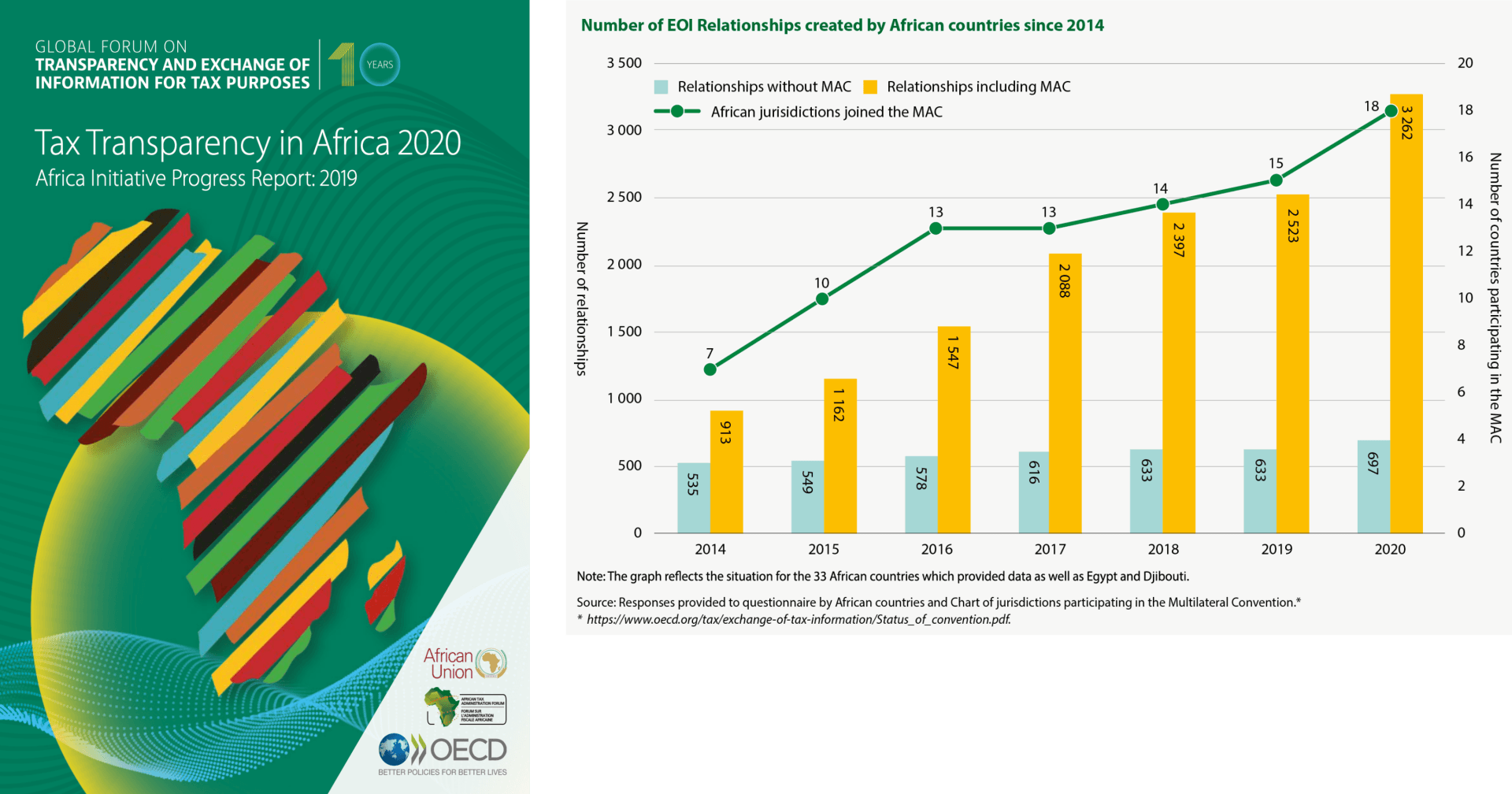

African countries’ EOI network has been expanding rapidly. It reached 3 262 bilateral relationships in 2019, compared to 685 in 2013. This is mainly due to the growing number of countries joining the Convention on Mutual Administrative Assistance in Tax Matters. The amount of EOI requests sent by African countries increased more than eightfold since the start of the Initiative in 2014. These impressive developments directly translated into additional tax revenue, allowing a group of eight African countries to secure USD 189 million extra revenue between 2014 and 2019.

Encouraging evolutions were also observed in the implementation of automatic exchange of information (AEOI): Ghana started exchanging in 2019, joining Mauritius, Seychelles and South Africa. Nigeria is expected to start in 2020 and Morocco in 2021. Assistance is ongoing with five countries to help them move towards the implementation of this standard. Interest in AEOI had been awakened by the remarkable outcomes of voluntary disclosure programmes launched prior to the first exchanges, with EUR 102 billion recovered globally, including USD 82 million in Nigeria and USD 296 million in South Africa.

Expanding partnerships for tax transparency

Three additional African countries joined the Global Forum in the last year and six added their weight to the Yaoundé Declaration. Active partnerships with the African Union Commission, the African Development Bank, the African Tax Administration Forum, the Cercle de Réflexion et d'Échange des Dirigeants des Administrations Fiscales, the West African Tax Administration Forum and the World Bank Group significantly contributed to the fight against IFFs and have helped raise political advocacy across the continent.

H.E. Prof Victor Harison, Commissioner for Economic Affairs of the African Union Commission, called on “all Member States to participate in the international tax cooperation by implementing fiscal transparency strategies that fight against illicit financial flows (IFFs), and mitigate tax evasion on the continent. He further noted that domestic resource mobilization (DRM) is essential for the transformation, self-reliance and sovereignty of the Continent in order to build an endogenous economy and achieve Agenda 2063.

Remaining challenges

Despite the progress, important challenges remain ahead, among which the expansion of staff’s knowledge, the availability of beneficial ownership information and the effective implementation of AEOI. Thirty training events have been organized since 2015 and more than a thousand officials from 44 African countries have been trained.

According to Mr Logan Wort, Executive Secretary of ATAF, “now more than ever, the work on increasing transparency is important for Africa, and the collaborative efforts of ATAF and the Global Forum will ensure that African countries increase their exchanges of information while contributing to the fight against illicit financial flows.”

The Global Forum and its partners will continue to support African countries to address outstanding issues and help them close the gap with other jurisdictions.

For further information on the report, please contact:

African Union Commission:

Dr. Yeo Dossina, Head of Economic Policy and Research, DossinaY@africa-union.org and/or Ms. Djeinaba Kane, Economic Policy and Research Division, KaneD@africa-union.org, Department of Economic Affairs, African Union Commission.

OECD Centre for Tax Policy and Administration and Global Forum:

Mr Pascal Saint-Amans, Director of the OECD Centre for Tax Policy and Administration, pascal.saint-amans@oecd.org or Ms. Zayda Manatta, Head of the Global Forum Secretariat, zayda.manatta@oecd.org.

African Tax Administration Forum:

Mr Logan Wort, Executive Secretary, African Tax Administration Forum, lwort@ataftax.org.

For media inquiries:

African Union Commission:

Ms. Doreen Apollos, Department of Information and Communication, ApollosD@africa-union.org, African Union Commission.

Global Forum:

Mr Julien Dubuc, julien.dubuc@oecd.org, Communications Officer, Global Forum.

African Tax Administration Forum:

Mr Romeo Nkoulou Ella, Manager Media and Communications, African Tax Administration Forum, rnkoulouella@ataftax.org.

The Full Report is available for download in French.