AFRICA INTEGRATION DAY

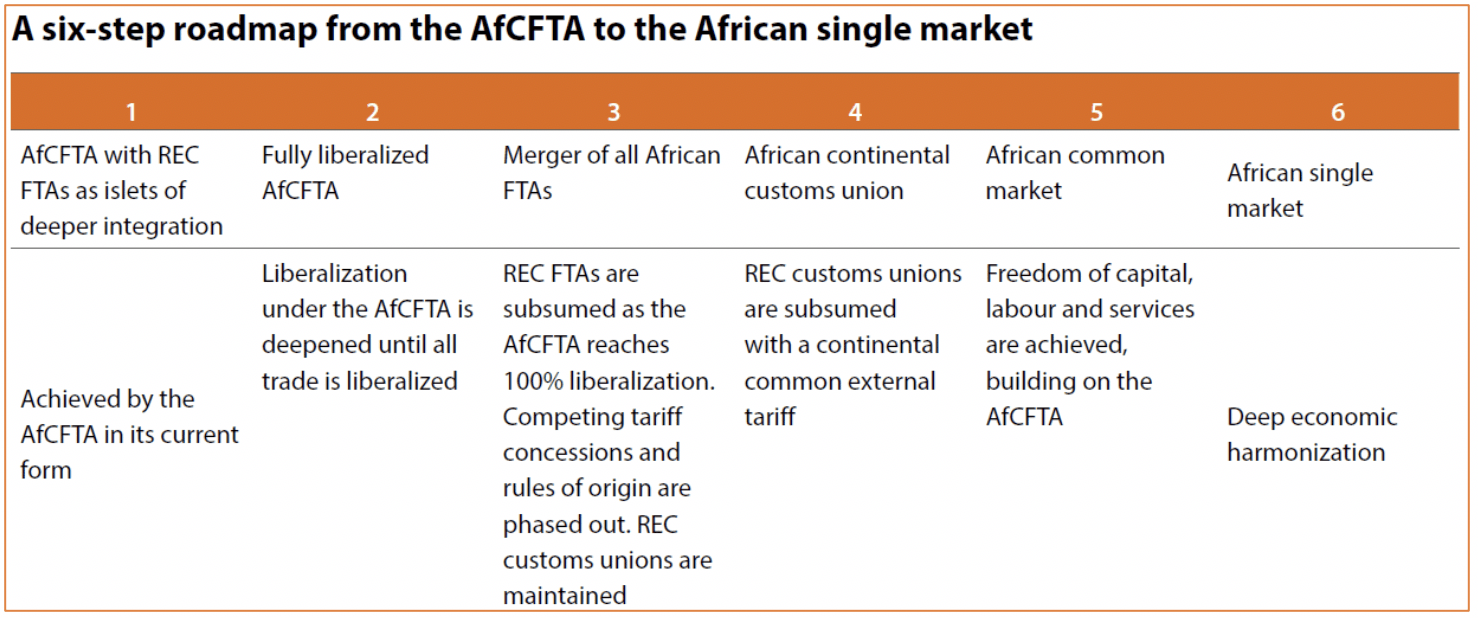

Source: Roadmap from the AfCFTA to the African single market. Reprinted from “Next Steps for the AfCFTA, by ECA/AU/AfDB/UNCTAD (2019). Copyright 2019 by ECA/AU/AfDB/UNCTAD.

The next phase relates to protocols on investment, intellectual property rights and competition. The policy issues under these protocols will among others be on gender, data, inclusion, informal trade, consumer protection, e-commerce and most importantly taxation.

Taxation in Africa Integration

Taxation is the lifeblood of every nation and is key to financing the attainment of the Sustainable Development Goals (SDGs). Since the ultimate aim of regional integration is to attain the economic growth of member states and increase the welfare of the citizens, tax revenues play a crucial role. A significant amount of literature posits that taxation is a key pillar of regional integration. It is therefore not surprising that it is also the most contentious issue in regional integration negotiations. Most countries fear the loss of revenue from trade taxes due to trade liberalisation in addition to other fears such as the loss of sovereignty and the loss of the manufacturing base. In fact, these were some of the reasons for the delay in Nigeria signing the AfCFTA. As Africa deepens integration, issues of cross-border indirect taxes (e.g. trade taxes, and value-added tax) as well as taxation of income (e.g. corporate income tax) will be critical.

The subsequent section identifies four crucial tax-related considerations that will foster a deeper Africa integration amongst African member states.

1. VAT as a replacement tax to loss of revenue from trade taxes

At stage 3 of the integration process, member countries will have to liberalise 100% of their tariffs. As a result, the number one fear of many African countries, and thus an impediment to Africa integration, relates to the loss of trade tax revenue due to trade liberalisation. The fear of the loss of Customs revenue is justified because according to the 2017 ATAF’s African Tax Outlook (ATO) publication, Customs revenue contributes an average of 35% to total revenue basket. The IMF estimates that member countries may lose about 1% to 5% of GDP depending on the structure of their economies. To minimise the revenue loss, some country-specific study recommends that countries should strategically liberalise the rest of products while keeping tariff lines for sensitive and excluded products over a longer period of liberalization and that the exclusion list should contain a significant amount of capital goods. The study is however quick to assure that the impact of trade liberalisation may be bi-directional as member states may well benefit from trade creation emanating from the AfCFTA.

To deal with this number one impediment to African integration, some literature suggests that VAT should be used as a replacement tax to mitigate the revenue losses from trade taxes. The VAT is a likely candidate for this role mainly because it is a broad-based consumption tax and again because of its tag as a money making machine. Therefore, it is imperative that as Africa integrates deeper, the strength of VAT as a possible replacement tax should be explored while mitigating its regressive nature. Furthermore, the cross-border nature of VAT and its application in the e-commerce should also be explored in order to maximise revenue collection through the VAT.

2. Increased tax revenue due to tax base expansion emanating from trade creation

Contrary to the fears of many AU member states, it is envisaged that the reduction or elimination of tariffs will spur an increase in the volume of imports and serve to expand the tax base from which will stem more tax revenue. Furthermore, the AfCFTA has the potential of bringing about trade creation which may eventually increase the taxable base and welfare of the people. Trade creation is attained when the volume of traded products increases due to the customs union thereby, on aggregate, increasing the total consumption in the domestic market. Simultaneously, this leads to a reduction in prices of goods that are in abundance in the domestic market, thus providing consumers with the option of choosing the cheaper domestic products over the imported products. Therefore, in the medium to long term, deeper regional integration through the AfCFTA can help promote local production and can boost domestic resource mobilisation in Africa.

3. Harmonisation of tax policies.

As observed by the IMF, for Africa to further integrate up to establishing the customs union and later, a monetary union, an inadequate level of harmonisation of tax policy amongst members can greatly compromise the whole integration process. Since taxes are a symbol of sovereignty, member states will justifiably be reluctant to forego fiscal independence, thereby compromising the later stages of Africa integration. Success in harmonising key tax policies in the AfCFTA will be crucial for overall African integration. Harmonising tax policies is also important for the removal of tax distortions, improving the investment climate, and ultimately realising economic growth. Most importantly, harmonising tax policies has a great potential of limiting tax competition and harmful tax practices by various countries with the aim of attracting foreign direct investment (FDI).

4. Taxation of the e-commerce/the digital economy

It is a stylised fact that electronic commerce (e-commerce) is growing at a fast pace in Africa. For instance, the United Nations Conference on Trade and Development (UNCTAD) in its report called “UNCTAD B2C E-Commerce Index 2018 Focus on Africa” estimates that since 2014, the number of online shoppers in Africa has been increasing by an annual average of 18%. The launch of the AfCFTA is likely to accelerate e-commerce and lead to increased intra-African trade, thereby deepening Africa integration. It is therefore not surprising that the AfCFTA protocol on e-commerce was included as a negotiation agenda.

At the same time, the rise in e-commerce poses as a taxation challenge to many African countries. The African Tax Administration Forum (ATAF) reports that many African countries experience significant challenges to taxing e-commerce because the digitalisation of the economy permits multinational enterprises (MNEs) to carry out business in African countries with no or very limited physical presence in those countries. This challenge emanates from the global tax rule that allocates taxing rights to a country where a sufficient level of connection of a non-resident enterprise to the tax jurisdiction is established. The nature of the digitalised economy makes it hard to establish this nexus and this poses a significant tax risk and may cost African countries millions of dollars.

Negotiations at the OECD Inclusive Framework to reconsider this global tax rule remain ongoing. Due to COVID 19, as well as some individual members requests for postponement on the decision on global taxing rights in this OECD-led debate on taxing the digital economy, there is likely to be no global consensus this year. As set out in the ATAF Policy Brief titled Digital Services Taxation in Africa, the lack of rules on the continent to tax highly digitalised businesses may cost African countries millions of dollars in tax revenue with many such businesses seeing significant increases in their profits during the COVID-19 pandemic. African countries may need to consider whether to introduce unilateral interim rules to tax highly digitalised businesses. ATAF is developing a Suggested Approach to Drafting Digital Services Tax (DST) Legislation that will set out a series of options for African countries’ consideration when drafting such legislation. The AfCFTA protocol on e-commerce that is yet to be negotiated may be informed by ATAF’s ongoing work on the subject to craft a unified regulation on e-commerce. This can used as a tool to deepen Africa integrations while at the same time preserving the much-needed tax revenues. This will also help Africa have one voice on matters relating to taxation of the digitalised economy.

In conclusion, taxation really matters for Africa integration and it can be used to accelerate the AfCFTA as a tool to cushion the revenue losses from trade taxes and a tool to deepen integration by harmonising tax and fiscal policies at customs union stages of regional integration. Thus, if the AfCFTA is implemented with sound and harmonised tax policies, the overall revenue yield can be preserved and AfCFTA can easily be accelerated. Therefore, it is important that the AU works closely with the Regional Economic Communities (RECs) and international institutions and organisations working on tax in Africa such as ATAF and United Nations Economic Commission for Africa (UNECA), in order to explore efficient and effective avenues to leverage taxation to achieve deeper Africa integration. This can further assist the AU plan and lay out tax regulations to deal with potential taxation challenges in Africa such as the taxation of the digitalised economy and the taxation of profits of multinational corporations which enjoy a high degree of financial mobility.

The research blog is available for download in French and Portuguese.