How can revenues be raised from the informal sector? Poll results on NEXUS

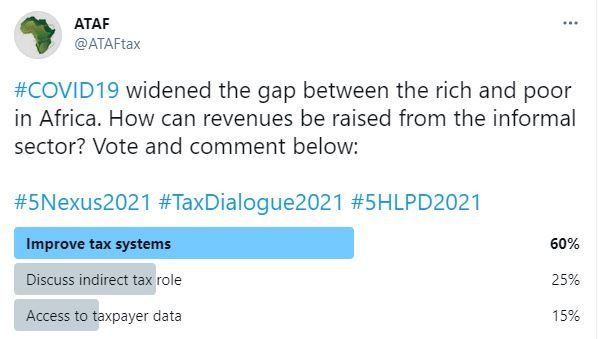

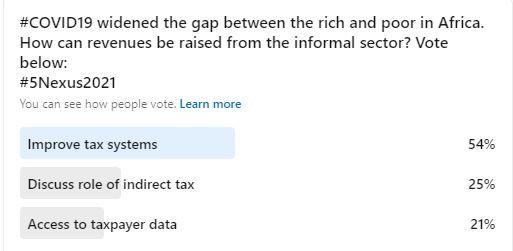

PRETORIA – The African Tax Administration Forums (ATAF) conducted a poll on social media platforms Twitter and LinkedIn to ask the question ‘COVID-19 showed the disparities in Africa. How can revenues be raised from the informal sector?’

The poll was done to garner attention and interest towards the 5th High-Level Tax Policy Dialogue. This virtual conference is in collaboration with the African Union (AU) and African Development Bank (AfDB). The theme is ‘Post-Covid Taxation: Policy and Administrative Strategies for Mobilising Enhanced Domestic Taxes in Africa.’

Social media users had three options to choose from in the poll, these were:

- Improve African tax systems by sharing ideas

- Discuss the role of indirect tax

- Access to taxpayer data and the effective use

The consensus on both platforms was clear. The people voted for the first option, agreeing that improving African tax systems by sharing ideas, could help revenues be raised from the informal sector.

On Twitter, 60 percent voted for the first option and on LinkedIn 54 percent also voted for the first option.

See the results below:

Remember to register for the virtual event by following this link: https://bit.ly/3niHuDs