Here’s what you need to know about day one of the 5th High-Level Tax Policy Dialogue

PRETORIA – The African Tax Administration Forum (ATAF) kicked off the first day of the two-day 5th High-Level Tax Policy Dialogue with discussions on balanced approaches to tax policy, the role of indirect tax policy and the future of resource taxation.

This virtual conference is in collaboration with the African Union (AU) and African Development Bank (AfDB). The theme is ‘Post-Covid Taxation: Policy and Administrative Strategies for Mobilising Enhanced Domestic Taxes in Africa.’

ATAF Executive Secretary Mr Logan Wort opened his address by thanking the AU and AfDB for their role in delivering the dialogue.

The Executive Secretary noted that the continent signed away billions of dollars through tax incentives for businesses.

“It is not tax incentives that attract direct investment, that’s a myth. Direct investment is attracted to a stable economy, good infrastructure, a good educated workforce and political stability. Those are things that attract investment,” Mr Wort added.

The ATAF chairman Mr Philippe Tchodie and the AU’s Albert Muchanga, Commissioner; Economic Development, Trade, Industry and Mining also gave their opening remarks, urging countries on the continent to continue working together and sharing ideas to recover from the COVID-19 pandemic.

SESSION ONE:

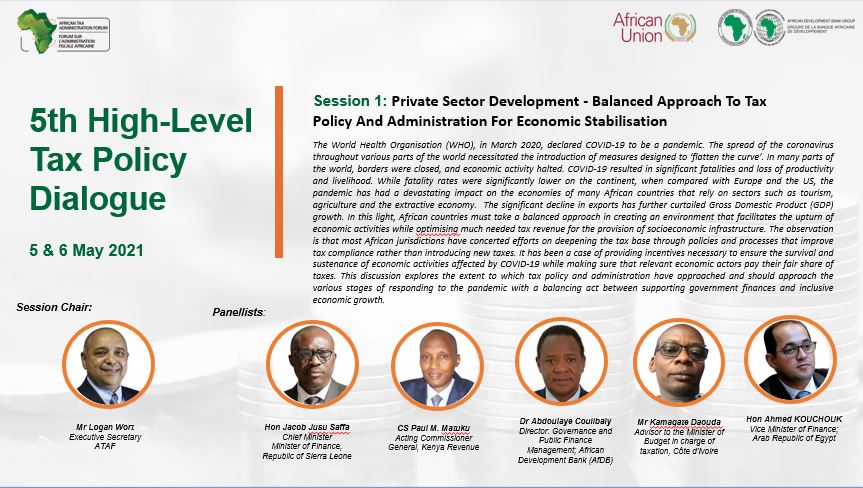

This session was chaired by Mr Wort. There was a slight change in panelists which included: Dr Yakama Jones, Director of Research at the Ministry of Finance of Sierra Leone Ramy Mohammed Youssef, Advisor to Administer of Finance of Egypt And, Dr Mohamed Omar, Commissioner: Strategy, Innovative and Risk Management at Kenya Revenue Authority.

The theme for this session was Private Sector Development - Balanced Approach To Tax Policy And Administration For Economic Stabilisation. Here’s a round-up of what was discussed:

- All panelists agreed that African countries were resilient during the COVID-19 pandemic.

- Mr Kamagate Daouda, Advisor to the Minister of Budget in charge of taxation, Côte d'Ivoire hailed a special plan with a significant budget, which was put in place to economically assist during the pandemic. He said those results are reaped in 2021.

- The significant decline in exports further curtailed Gross Domestic Product (GDP) growth.

- African countries taking a balanced approach in creating an environment that facilitates the upturn of economic activities while optimising much needed tax revenue for the provision of socioeconomic infrastructure.

- The extent to which tax policy and administration have approached and should approach the various stages of responding to the pandemic with a balancing act between supporting government finances and inclusive economic growth.

SESSION TWO:

This session was chaired by ATAF’s Ms Mary Baine, Director: Tax Programmes.

The theme for this session was COVID-19: The Role Of Indirect Tax Policy And Administration In Mitigating The Socioeconomic Impact Of The Pandemic. Here’s a round-up of what was discussed:

- One of the panelists, Mr Piet Battiau, Head: Consumption Taxes; OECD noted that A growing number of people using mobile phones, the growing number of online shopping (mobile payments). This is transformational and important to VAT.

- Tools to mitigate effects of the pandemic.

- Indirect tax revenues

- VAT being the highest contributor to total tax revenue at 30.6%.

- Considering the contribution of indirect tax to DRM in Africa and its relationship with economic decisions at the micro and macroeconomic levels.

- The role of indirect tax in fostering economic recovery and growth.

SESSION THREE:

The last session was chaired by Ms Varsha Singh, Advisor to the Executive Secretary at ATAF.

This session’s theme was The Future Of Resource Taxation. Here’s a round-up of what was discussed:

- Panelists in this session agreed that tax payers and administrators welcome the measures taken to mitigate COVID19 effects.

- Mr José Leiria, Member of the Board, Autoridade Geral Tributária, Angola stressed that African leaders must understand that mining resources need to be valued and of service to African communities where they are being extracted.

- Weak enforcement of tax laws and overly generous tax incentives.

- Exchanging ideas on how the current system of mining taxation can be improved.

- Alternative options available to resource-rich countries to maximize the returns from their mineral wealth.