AWITN Leader Jeneba J. Bangura Appointed Deputy Finance Minister 1 in Sierra Leone

Bangura's impressive resume includes experience working for the State Comptroller's Office of New York and the Metropolitan Transportation Authority.

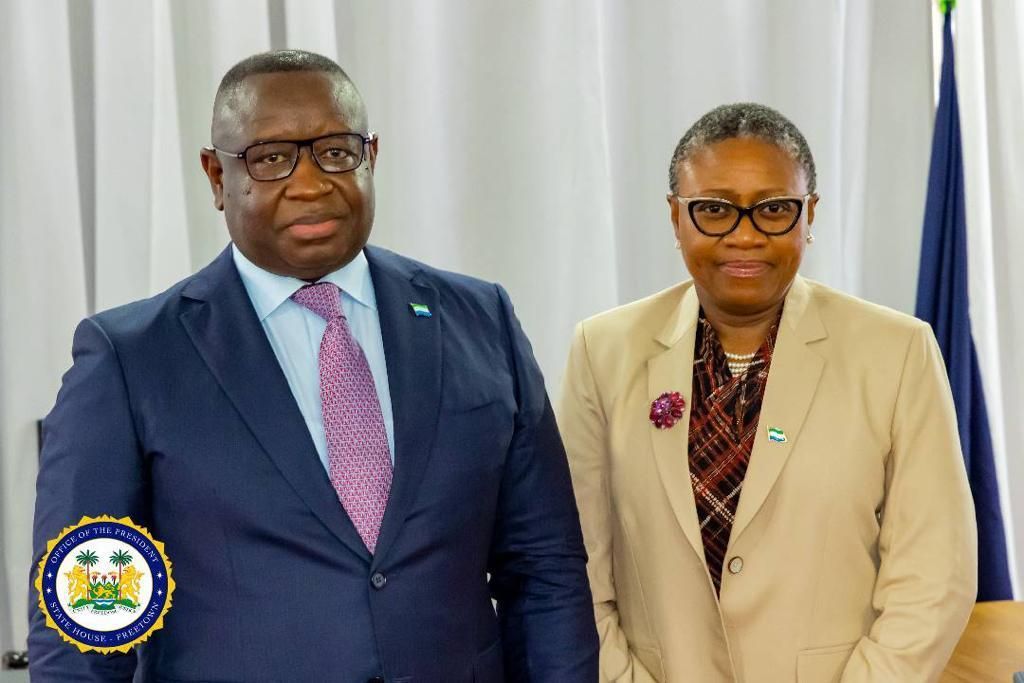

President of Sierra Leone, Dr. Julius Maada Bio together with Jeneba J. Bangura, Deputy Minister of Finance 1 of Sierra Leone.

In a testament to the importance of women in tax, ATAF Women in Tax Network (AWITN) member Jeneba J. Bangura has been appointed as the Deputy Minister of Finance 1 of Sierra Leone.

The announcement in July this year came from the president of Sierra Leone, Dr. Julius Maada Bio, who had previously tapped Bangura to serve as Deputy Commissioner-General (DCG) of the National Revenue Authority (NRA) since 2018.

Bangura's impressive resume includes experience working for the State Comptroller's Office of New York and the Metropolitan Transportation Authority, the largest public transportation system in North America. She holds a master's in public administration and is a certified public accountant.

In 2018, Bangura answered the call of President Bio, who urged citizens in the diaspora to return home and join the efforts for nation-building. Her role as the DCG was instrumental in implementing massive reforms, including the automation of tax administration systems.

"It is with deep fulfillment to mention that together as an institution, we increased revenue/GDP ratio from 12.3% of GDP in 2017 to 15.7% of GDP in 2021, representing an increase of 3.4 percentage point just within four years. Despite the impact of Covid and other shocks like the war in Ukraine, our revenue/GDP ratio resisted due to the reforms we embarked on," she explained.

In a recent interview, she highlighted the importance of mentorship, particularly for women in Sierra Leone.

"We implemented a mentorship programme geared towards women," Bangura said. "Together with the leadership of the authority, we paired senior tax administrators with not only new staff but middle management as well. It worked out well."

The impact of this mentorship program can be seen in the numbers. In 2018, female representation in the authority was less than 10%. Under Bangura's leadership, that figure rose to about 23%.

Her role as one of the ambassadors for the ATAF Women in Tax Network underscores her commitment to women's empowerment.

Bangura emphasised the importance of women's participation in decision-making processes, not only as tax mobilisers but also as influential decision-makers.

"It is important to have women in these decision-making paths," Bangura stressed.

She also played a key role in tax mobilisation, especially in the informal sector that included training women at border crossings and making technological adaptations to suit their needs.

"We ensured that we made the system malleable and conducive to their situation, especially for women at the border crossings. We provided the enabling environment and made the declaration process simple for them," she explained, emphasising the importance of having women involved in decision-making roles.

Bangura's appointment is seen as a reflection of Sierra Leone’s commitment to the implementation of the new gender equality law, efficient revenue mobilisation, and innovative financial policies. Her leadership at the NRA, where she championed reforms and ensured a continuous training program for staff, has been widely praised.

Bangura emphasised the importance of understanding taxes as a development issue rather than a punishment. "Yes, definitely. Tax is a development issue. It's wrong to see tax mobilisation as punitive, and the only way that can be made clear is through continuous taxpayer education and private sector engagement," she stated.

Sierra Leone's finance sector looks poised to benefit greatly from Bangura's expertise, strategic thinking, and progressive approach to gender equality. With

her unique blend of financial acumen, innovative thinking, and unwavering dedication to mentorship, Bangura is a beacon for future leaders in Sierra Leone. Her message is clear: "It's vital to have women at the table." And she has proven she is not only willing to make space at that table but also actively prepare others to take their seats.