Impact of Value-Added Tax in revenue stability in some African countries – Policy and compliance gaps using the C-efficiency

- The fast-tracking of VAT refunds, with specific treatment for smaller VAT taxpayers.

- A case-by-case application for a waiver of penalties by large taxpayers that can show they are incapable of making tax payments due to the COVID-19 disaster.

- The suspending of mineral import duty.

- Extending the filing and payment deadlines for tax returns, and

- Cutting taxes on medical products, among others.

The COVID-19 pandemic will certainly deepen the policy gap component of the C-efficiency because of unavoidable and necessary exemption measures introduced specifically in response to the pandemic which will have the impact of reducing VAT revenue. However, the widening of the policy gap may be mitigated, by opting for targeted, not blanket, interventions. For example, through limiting the application of VAT exemptions to only the importation of goods used to support the health system and combat the effects of the COVID-19; the temporary increase of the turnover threshold for the application of the simplified VAT regime mainly for small businesses; or the temporary reduction of the VAT standard rate only for services and food supplied by entities providing hotel and restaurant services.

On the other hand, a rise in the extent of the compliance gap, which can originate from imperfections in the implementation of the existing VAT system in an economy or from excess credit returns and refund claims, may exacerbate the size of the shadow economy. In this instance, approaches to curb the compliance gap during COVID-19 may include accelerating VAT refunds mainly for small and medium size businesses classified as "reliable taxpayers" (i.e. who have a good compliance record) to preserve their liquidity and cash flow; or by the deferral of VAT payments for all companies with sales below a certain threshold.

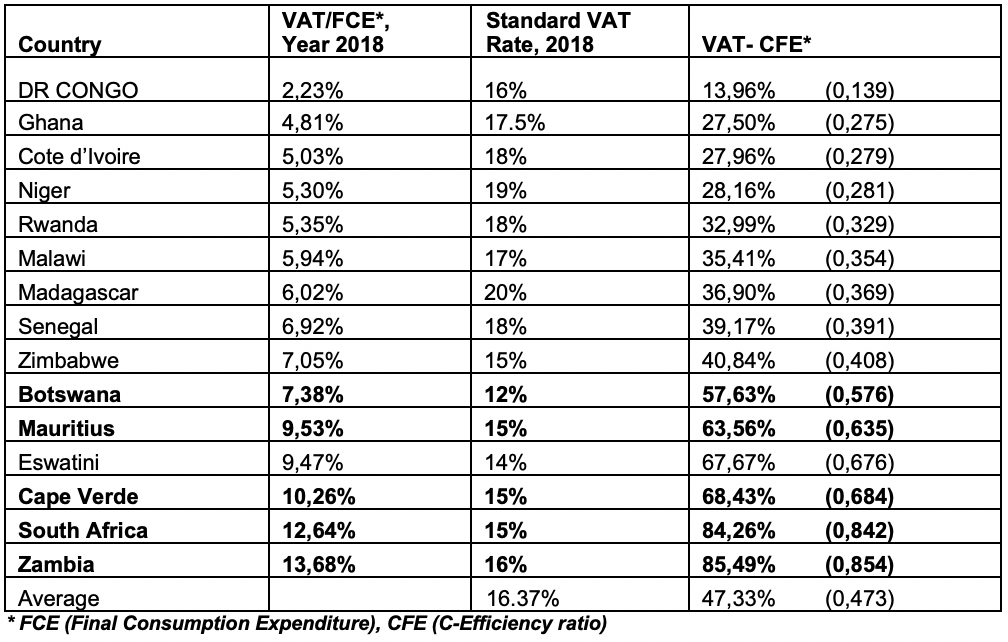

In general, while these measures will not significantly improve revenue collection in the short-term, countries should be careful that the emergency measures they put in place do not have a negative long-term effect on VAT collections. More importantly, as the table shows, there is plenty of room for improvements in the efficiency of VAT collection. It is imperative that tax administrations continue to implement measures which will increase tax revenue in the long term.

These include the modernisation and automation of the VAT registration, filing, returns, and payment processes and the adoption of more robust assurances processes. Other things that may be considered – expansion of tax base e.g. cross border e-Commerce, drive to bring non-registered taxable persons into the tax net, review of exemptions. Also, taxpayers’ engagement and enlightenment will be important. These processes will enable tax administrations to improve their C-efficiency ratios and provide the foundation for tax systems that are able to adapt quickly to future crises such as the current COVID-19 pandemic.

The policy brief is available for download in English, French and Portuguese.