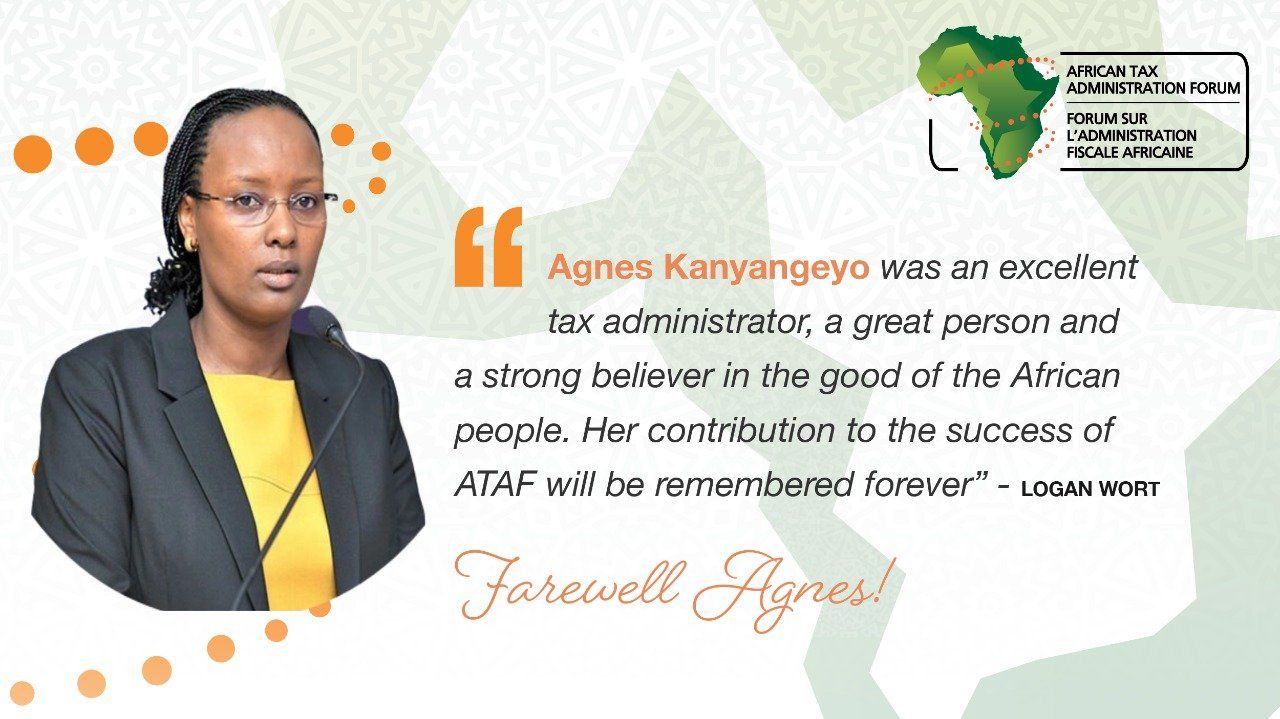

TRIBUTE TO AGNES KANYANGEYO

Mere words cannot express the shock and pain we at ATAF have on learning about the passing of Agnes, the former Deputy Commissioner- General of the Rwanda Revenue Authority, an accomplished continental tax practitioner, friend, and dear colleague to us all! Our hearts go out to her family, the RRA family and all who were privileged to know Agnes.

Brilliant, principled, and knowledgeable, Agnes was an excellent tax administrator. A strong believer in the betterment of humanity in general and the African people in particular, she relentlessly promoted efficiency in tax collection as a means to address the developmental needs on the continent. An unapologetic ATAF champion, Agnes contributed to ATAF’s work consistently, and way beyond her call of duty.

The highlights of her contributions as a Country Correspondent representing her Country Rwanda at ATAF Council and other meetings, are immeasurable and will live on in the products, policies she helped formulate. Quietly but firmly expressing her truth and ideas with a permanent smile that we all loved, her contributions now form part of ATAF’s flagship work such as the African Tax Outlook, an annual tax statistics publication, in whose 2015 launch -she was instrumental.

Accomplished in the tax field, Agnes was a force of nature, passionately supporting the development of tax expertise on the continent and selflessly sharing her vast knowledge through mentoring others and encouraging consistent self-development. For this and way more, we at ATAF feel blessed to have known Agnes, and mourn with her family, the RRA family and entire tax fraternity on this loss of a formidable icon, gone too soon!

As aptly put by Sri Chinmoy;

Death is not the end

Death cannot be the end

Death is the road

Life is the traveler

The soul is the guide.

May Agnes rest in peace, and may her memory be a blessing!