Preparing for the Future: Key Insights for the ATAF Annual Meetings

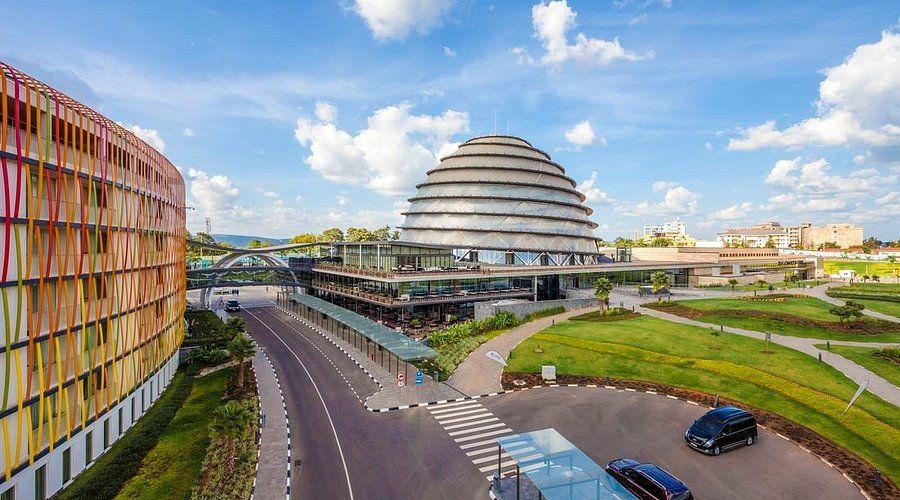

The African Tax Administration Forum (ATAF) is gearing up for one of its most significant events of the year— the Annual Meetings. Hosted by the Rwanda Revenue Authority, this year’s gathering will take place from December 2 to 6, 2024, at the Kigali Convention Centre.

The African Tax Administration Forum (ATAF) is gearing up for one of its most significant events of the year— the Annual Meetings. Hosted by the Rwanda Revenue Authority, this year’s gathering will take place from December 2 to 6, 2024, at the Kigali Convention Centre, running daily from 9 AM to 5 PM.

This year's theme, Preparing for the Future: Revenue Administration in a Dynamic Global Landscape, will focus on the critical role of domestic revenue mobilization in promoting economic independence and sustainable development. Discussions will also emphasize leveraging digital technologies to boost tax collection efficiency, improving data analytics to combat tax evasion, and enhancing international cooperation to address cross-border tax challenges.

As the tax landscape evolves, attending the ATAF Annual Meetings offers valuable insights into best practices, innovations, and challenges in tax administration. Engage in workshops, presentations, and discussions that will shape tax policy on the continent, contributing to more effective governance and advancing tax administration in Africa.

The event is ideal for a diverse audience, including:

- Officials from African tax administrations and ministries of finance

- Government representatives involved in tax policy and economic development

- Representatives from organizations such as the African Union, African Development Bank, IMF, World Bank, and regional bodies

- Scholars focusing on tax policy, economics, and public finance

- Business leaders and tax professionals offering insights on compliance and administration

- Organizations dedicated to transparency, governance, and economic justice

Beyond the informative sessions, the Annual Meetings will provide excellent networking opportunities. Connect with like-minded professionals, industry leaders, and stakeholders to expand your network and resources.

Secure your spot in Kigali, Rwanda, for this pivotal event by registering here.