Here are the themes you are interested in for the ICT guidebook launch

PRETORIA – The African Tax Administration Forum (ATAF) is getting ready to launch its highly anticipated ICT Tax Systems and Informal Sector Seminal Guidebooks on 24 June.

The ICT book titled the Efficient Acquisition, Implementation and Maintenance of Integrated Revenue Administration Systems in Africa Guidebook, draws on information gathered from a comprehensive study of ICT systems of tax administrations in 35 countries across Africa.

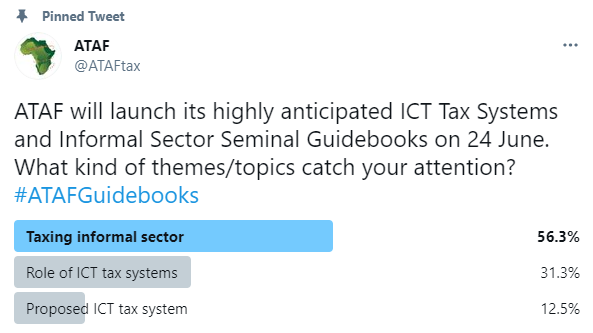

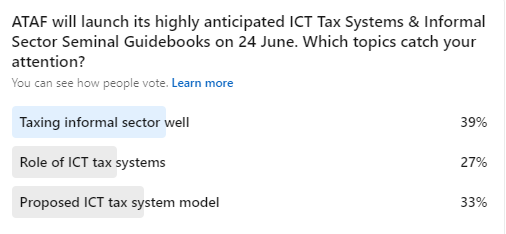

ATAF asked through its two social media platforms; LinkedIn and Twitter, ‘What kind of themes/topics catch your attention?’

These were the options given for people to vote:

- Taxing informal sector

- Role of ICT tax systems

- Proposed ICT tax system

The overwhelming majority of people voted for option one ‘Taxing informal sector’ as a topic of interest.

ICT systems are a key investment for tax administrations to build process efficiencies, improve service delivery, enhance compliance, and lower costs.

The study assessed the implementation of ICT systems in African tax administrations to determine whether digitalised tax administrations with automated ICT systems have attained the expected gains and efficiencies from the ICTs.

To register for the launch, follow this link.