Global economic havoc underlines urgency of broadening the tax base in African countries

African Tax Administration Forum • March 25, 2020

Broadening the tax base has long been a burning issue for most African countries but the urgency has never been more pronounced due to the economic and social havoc being wreaked across the world by the Covid-19 pandemic.

There is a consensus that the economic fallout from the Covid-19 pandemic shutdowns will severely slash economic growth in countries all over the world. Indeed, some economists are warning of the possibility of a global recession. The impact on business activity, employment, consumer spending, and corporate profits cannot be under-estimated, especially in the short term. Stock exchanges indices have fallen steeply and businesses, big and small, are being negatively impacted. This in turn will translate into lower revenue collections.

While this will be the case throughout the world, it is of particular concern to countries in Africa. Most countries on the continent have very narrow tax bases across all of the three major tax types: personal income tax, corporate income tax, and value-added tax (VAT). Particularly disturbing is the extent to which African tax administrations are dependent on a small portion of taxpayers for their total tax revenues.

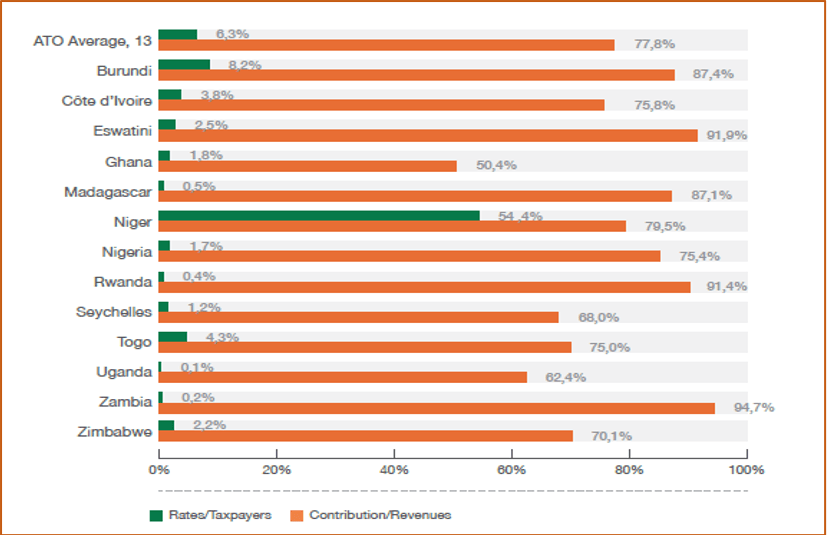

This extent of contribution is graphically illustrated in the 2019 edition of the African Tax Outlook publication released by the African Tax Administration Forum at the end of last year.

The data, supplied by the relevant tax administrations, clearly shows that the contribution to tax revenue of large taxpayers (corporates), as defined by the respective ATO participating countries, outweighs their number in the taxpayer base as is illustrated by the graph below. The graph shows the total contribution made by large taxpayers, i.e. the sum of corporate income tax, VAT, Pay-as-you-earn tax (PAYE) and other payments such as import duties, Excise duties and royalties etc

Although corporate income tax contributions to total tax revenue average just 15.2% on the continent, businesses act as agents for the collection of VAT and PAYE. VAT is borne by the consumer and PAYE is a personal income tax withheld by employers from the remuneration of employees; businesses act as agents for the collection of these taxes which are paid over to tax administrations. When all the payments are factored in, the graph points to an unhealthy and risky reliance on just a few taxpayers.

Contribution of Large Taxpayers in ATO Countries, 2017

Source: ATAF (2019), ATAF’s African Tax Outlook 2019, African Tax Administration Forum Publication, Pretoria, https://events.ataftax.org/index.php?page=documents&folder=7

The data for the year 2017 highlights the risk. It shows that in four countries fewer than 1% of taxpayers contributed over 62% of the total revenue collected. The countries are:

- Uganda, 1 taxpayer in 1 000 (0.1%) contributed 62.4% of revenue

- Zambia, 2 taxpayers in 1 000 (0.2%) contributed 94.7% of revenue

- Rwanda, 4 taxpayers in 1 000 (0.4%) contributed 91.4% of revenue

- Madagascar, 5 taxpayers in 1 000 (0.5%) contributed 87.1% of revenue.

Although not as stark, the situation in the remainder of the countries is only a little less alarming. In 12 of the 13 ATO countries that provided data, less than 10% of taxpayers contributed more than 50% of the total revenue collected.

“The data shows that in countries surveyed by the ATAF’s ATO project, revenue depends heavily on a handful taxpayers; on average, just 6.3% of large taxpayers generate 77.6% of receipts. A more balanced ratio is to be found only in Niger, where 54% of taxpayers contribute almost 80% of the country's tax revenue,” said Dr Nara Monkam, ATAF’s Director of Research.

“The heavy dependence on a small number of taxpayers is a risk to revenue mobilisation and budgets. Indeed, should any of them experience economic difficulties, the entire budget balance would be jeopardised,” she added.

Moreover, large taxpayers generally are or belong to multinationals that widely practice tax optimisation, depriving states of substantial income. Multinational companies are, for the most part, the riskiest taxpayers because of their aggressive tax planning, according to the OECD1.

Preliminary data for 2018 and 2019 collected for the upcoming 2020 edition of the ATO publication shows no real progress. Such risky over-dependence underlines the fact that action to broaden the tax base to mitigate risk and ensure revenue stability and revenue sustainability are well overdue in African countries.

“It is important that tax authorities find strategies for increasing contributions from other categories of taxpayers. Determining the share of active taxpayers by type of tax, for example, can help them identify certain tax niches,” Dr Monkam said.

Critical areas for tax base broadening initiatives are micro and small businesses, many of whom operate in the informal sector that constitutes a significant proportion of economic activity in African countries but remains overwhelmingly outside the tax net. However, it is essential that tax administrations strike a balance between the revenue collection objective and the long-term sustainability of the businesses. As the old adage says, “we cannot kill the goose that lays the golden egg”.

“ATAF is researching effective ways of taxing informal sector entities without jeopardising economic activity as a step towards formalising and boosting this sector that contributes to both employment and GDP in many of our member countries,” Dr Monkam explained.

The 2019 edition of the African Tax Outlook, and past editions are available for download here.

About ATAF

The African Tax Administration Forum is an organisation which was established by African revenue authorities in 2009, in order to improve the performance of tax administrations in Africa. The tax administrations of 38 countries in Africa are members of ATAF, i.e. 75% of tax administrations on the continent, making it the premier body on tax matters in Africa. Two additional countries, Mali and Somalia, are in the process of joining the organisation. ATAF believes that better tax administration will enhance economic growth, increase accountability of the state to its citizens, and more effectively mobilise domestic resources. Now in its 10th year of existence, ATAF has positioned itself as Africa’s homegrown solution to improving revenue collection, advancing the role of taxation in governance and state-building and providing a voice for the continent on international tax issues.

For more information:

Mr Frankie Mbuyamba – Programme Specialist - ATO & Tax Statistics

Cell : +27 (0) 63 689 3896

Email : fmbuyamba@ataftax.org

Romeo Nkoulou-Ella – Communications manager

Cell: +27 (0) 79 790 2960

Email: rnkoulouella@ataftax.org

________________________

1. OECD/ATAF/AUC. (2017). Revenue Statistics in Africa. Paris: OECD Publishing.