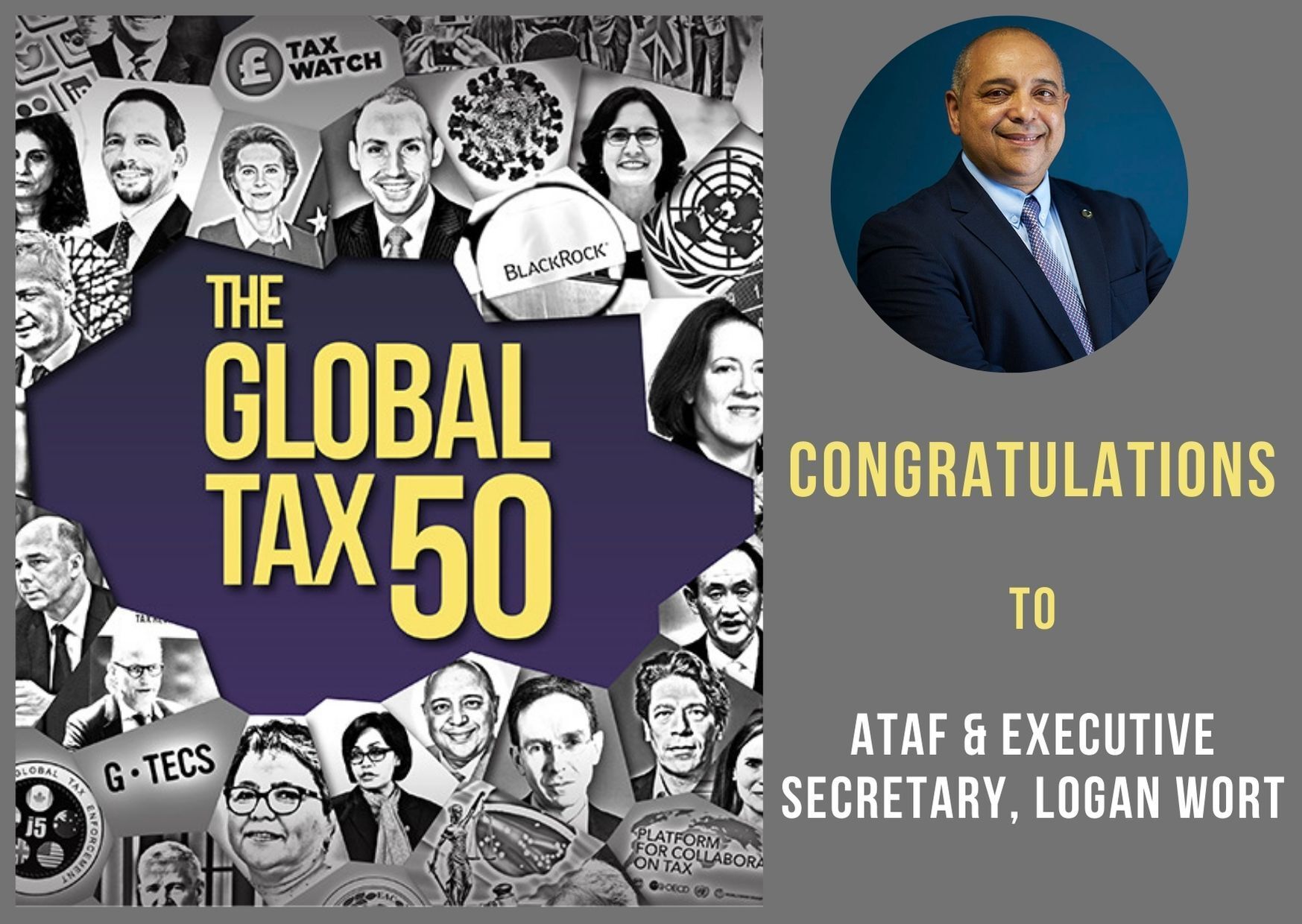

ATAF’s Logan Wort ranked 8th in the top 50 most influential figures in Tax

African Tax Administration Forum • February 8, 2021

Pretoria, 05 February 2021 – This year’s prestigious Global Tax 50 list which features a rundown of the most influential individuals, movements, organisations and trends in the global tax arena, includes the Executive Secretary of the African Tax Administration Forum (ATAF), Mr Logan Wort, among its top 10 awardees.

The Global Tax 50 Awards are published annually by the International Tax Review (ITR) after rigorously assessing what, according to their analysis, have been the most impactful trends, individuals and organisations in the tax world over the past 12 months.

According to ITR, the African Tax Administration Forum (ATAF), led by its Executive Secretary, Mr Logan Wort, has played and continues to play a key role in bridging the gap between the expansion of multinational companies in Africa and the tax challenges faced by businesses in the region, where tax administration and policy are still developing.

“The growing influence and role [of ATAF] in developing and providing support to African countries places it in ITR’s Global Tax 50.” Says the ITR.

Founded in 2009, the ATAF has established itself as Africa’s voice on continental and international tax matters; a position that it has further consolidated through its critical representation of Africa’s interests at the on-going global discussions on the taxation of the digital economy, its continuous capacity-building and technical assistance initiatives for African tax authorities and more recently, its rapid response to the COVID-19 induced challenges faced by African tax administrations, which included several consultations with tax authorities and a set of recommended measures to address the impact of the pandemic.

In an interview

accorded to the ITR for the occasion, Mr Wort indicated that “at the global level, the intensity of ATAF’s work on the global framework for the taxation of the digital economy (…) has produced technical responses and analyses that have been used and are looked forward to by developing countries in other regions.”

The work done by ATAF over the years on the United Nations Tax Committee (UNTC) has also contributed to shifting the Committee’s agenda to a broader tax policy that is more reflective of the global framework agenda, he added.

At the continental level, ATAF’s active lobbying has resulted in the African Union Commission placing tax as a priority on its agenda which, according to Mr Wort, has also been an important highlight in 2020.

COVID-19 and Digital transformation occupied the top spots on the ITR’s list due to the impact they’ve had and continue to have on the way businesses and tax administrations operate globally.

It is therefore no surprise that post-COVID revenue mobilisation and tax systems recovery on the one hand, and the finalisation of the Inclusive Framework’s work on the taxation of the digital economy have been set as key focal points for ATAF in 2021 according to Mr Wort.

Visit https://www.internationaltaxreview.com/article/b1qf1gxl7mythd/itr-global-tax-50-2020-21-logan-wort

for the full interview.

The press release is available for download in French

and Portuguese.