ATAF Women in Tax: Everything you need to know about the network

The ATAF Women in Tax Network is an association which encourages the participation of African women working in taxation in government, private sector, civil society and academia.

PRETORIA - Taxation and gender equality are two issues of strategic importance to developing countries in general, and Africa in particular. Tax is one of the most potent tools in the reduction of the inequality gap between the rich and poor as well as between men and women.

To this effect, the African Tax Administration Forum (ATAF) launched the Women in Tax Network in March 2021. The ATAF Women in Tax Network (AWITN) is a unique platform that represents and connects African women working in taxation with furthering discussion on the effect of tax policy on gender equality and empowering women in tax.

“This Network will be a very significant achievement in the fight for gender equality and a true milestone in ATAF’s history as it will provide leadership training and mentorship avenues to empower African women in tax” – Phillip Tchodie, Chairman of ATAF.

At the conclusion of its launch event, the AWITN set out to achieve the following objectives:

- Empower African women in tax

- Create a platform for female tax professionals to meet, exchange experiences, gain exclusive insights

- Increase the role of women in tax in Africa

- Build an African network of women in taxation

- Increase the participation of women speakers on tax on panels in Africa by hosting regular events

- •Facilitate forums to discuss the most pressing and current tax issues;

- Establishing a mentorship programme.

Furthermore, the Network will be an association which will encourage the participation of African women working in taxation in government, private sector, civil society and academia. The AWITN will:

- Look at tax and gender from different perspectives, including, but not exclusively, implicit bias in tax structures, differing experiences of women in relation to tax officials, whether men and women react to compliance measures differently, the role of women in the tax administration, the informal economy, etc.

- Work to improve gender balance in leadership positions in tax related organisations, by acting as a facilitator for institutional change and to identify ways of implementing that change.

- The network will also provide a support network at a more individual level to women in tax by facilitating mentoring and other developmental opportunities.

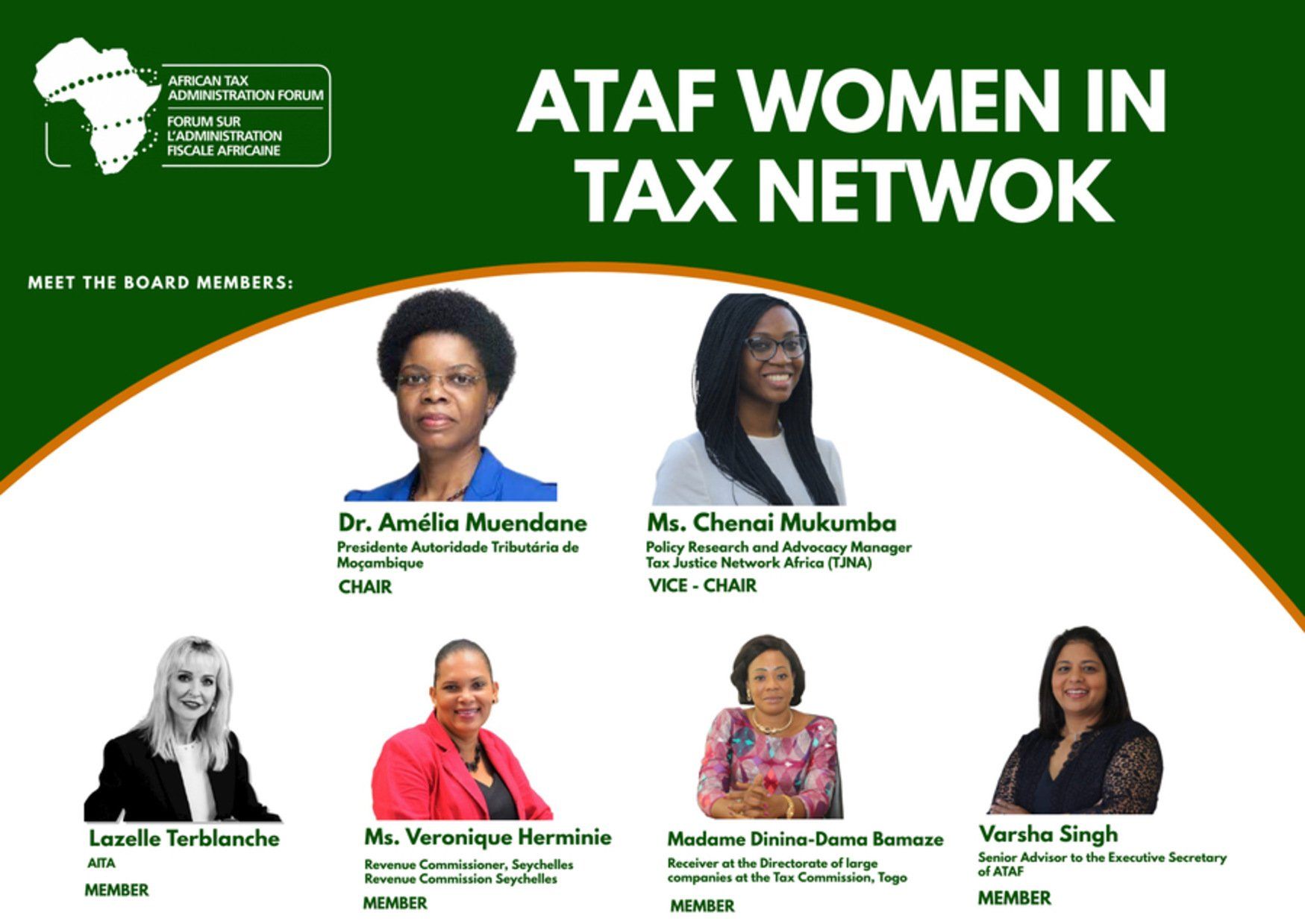

In May 2021, the AWITN elected its first Board, a group of women leaders who will preside over the destiny of the network over the next two years. Meet the board members below:

Mainstreaming gender equality is essential in the development and review of tax policies and administration, as the former supports an improved livelihood, while the latter fosters technical competence.

To learn more about the Women in Tax Network,

click here.