ATAF enhances Zimbabwe’s capacity to tax gaming and betting sector

This rapidly growing and complex sector poses significant challenges for tax authorities, requiring specialised skills to ensure effective taxation and promote compliance.

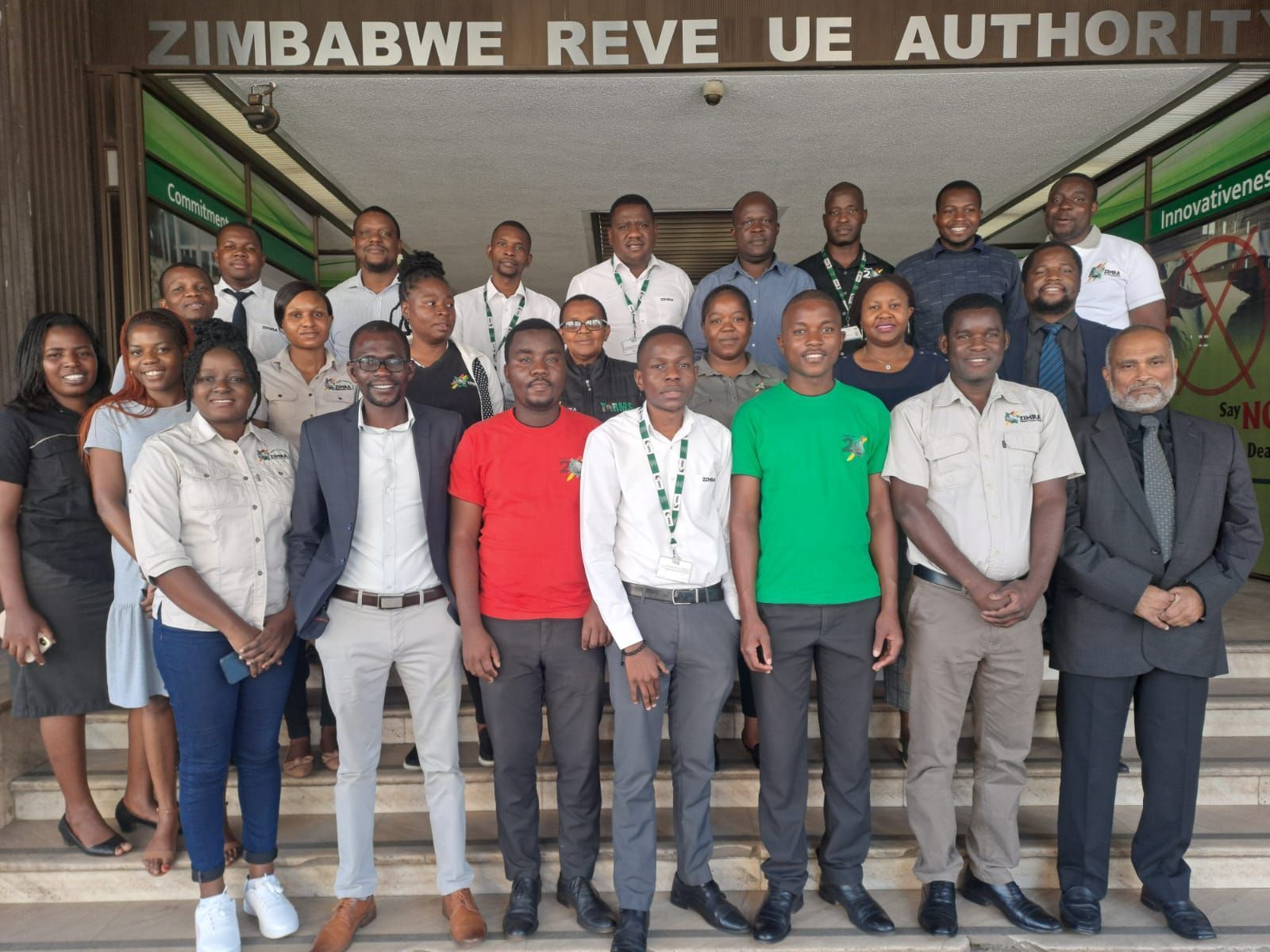

The African Tax Administration Forum (ATAF) provided technical assistance to the Zimbabwe Revenue Authority (ZIMRA) in Harare, Zimbabwe, focusing on the taxation and auditing of the gaming and betting Sector, from 9 to 13 September 2023.

This rapidly growing and complex sector poses significant challenges for tax authorities, requiring specialised skills to ensure effective taxation and promote compliance.

The training, led by Mr Phoolchand Ujoodha from the Mauritius Revenue Authority, was designed to equip ZIMRA tax audit officials with advanced knowledge to address the sector's unique complexities. With support from ATAF's Mr Moses Chamisa, the mission was successful in delivering valuable insights and practical strategies to bolster domestic resource mobilisation in Zimbabwe.

In addition to the technical assistance provided, the ATAF team held key discussions with ZIMRA's Executive Management, sharing insights on the sector's current state and identifying future needs for strengthening tax compliance. The collaboration between ATAF and ZIMRA marks another important step in enhancing Zimbabwe's tax administration capacity.

The mission not only reinforced the strong partnership between ATAF and ZIMRA but also highlighted the crucial role that skilled tax auditors play in ensuring fair and effective taxation within emerging industries like gaming and betting.