ATAF advocates for stronger health tax policies in West Africa

ATAF’s goal is to support African countries increase revenue through implementation of effective health taxes and implement policies that reduce consumption of harmful products such as tobacco. This workshop provided an opportunity for ATAF to continue to build capacity for counties in this area.

The African Tax Administration Forum (ATAF) took part in a workshop on "Promoting health and domestic revenue mobilisation sustainability through health taxes in West Africa" from 7-9 August in Ouagadougou, Burkina Faso.

Hosted by the West African Tax Administration Forum (WATAF), the workshop brought together tax policy officials, customs experts, and other stakeholders from the 15 ECOWAS member countries with the focus on exploring the potential of health taxes—levied on harmful products such as tobacco, alcohol, sugary beverages, and carbon dioxide emissions—as a tool for improving public health, environmental conservation, and economic sustainability.

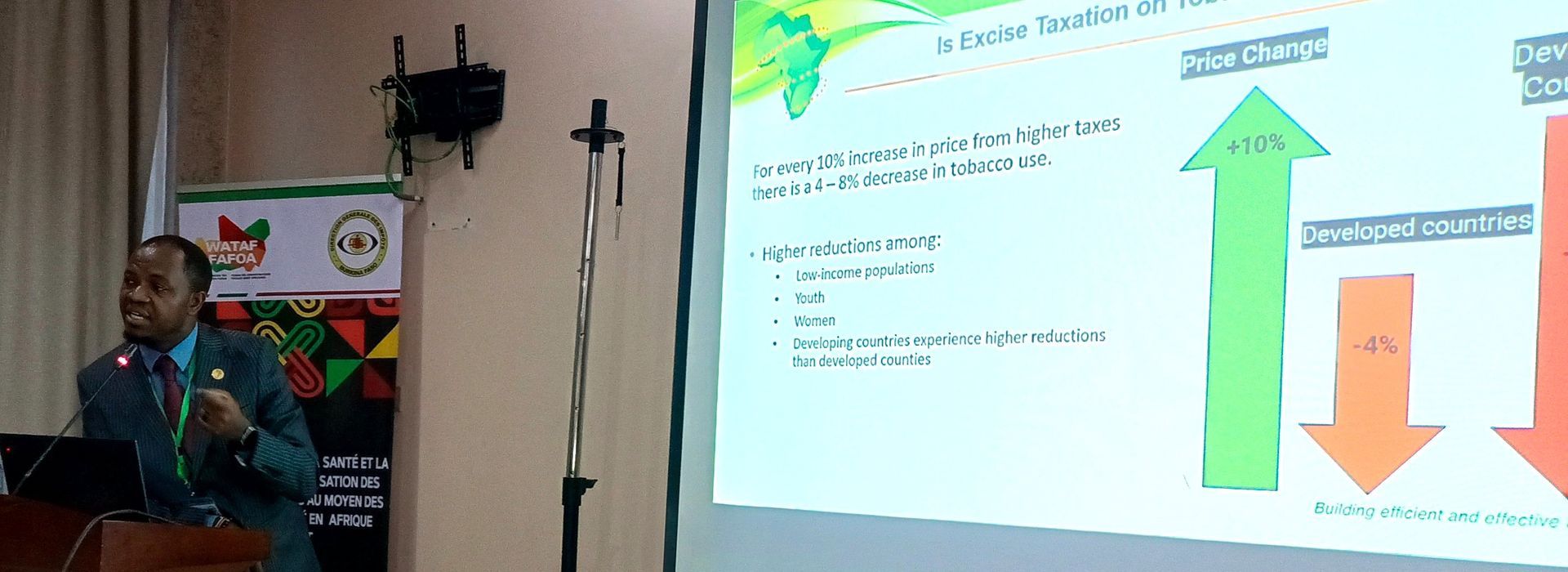

Representing ATAF at this event was Mr Linstrom K. Marangu, ATAF's Tobacco Tax Specialist. He delivered a keynote address in which he emphasised the dual role of health taxes in generating essential revenue and fostering a healthier society while drawing attention to the underutilisation of health taxes across many African countries despite their proven benefits.

“Health taxes are not just about bringing in money—they are about making a real impact on our society's well-being. By effectively taxing products like tobacco, alcohol, and sugary drinks, we can help reduce consumption, prevent diseases, and generate funds for crucial health initiatives.” Mr Marangu added.

Despite these clear benefits, health taxes remain severely underutilized in many African countries.

ATAF’s goal is to support African countries increase revenue through implementation of effective health taxes and implement policies that reduce consumption of harmful products such as tobacco. This workshop provided an opportunity for ATAF to continue to build capacity for counties in this area.

ATAF is also encouraging countries to implement modern technology to address challenges such as tax evasion and illicit trade which is a big challenge especially in excise taxes. ATAF therefore took the participants through emerging technologies and key considerations that countries should consider when implementing such technologies.

The workshop equipped participants with the knowledge and strategies to design, implement, and monitor health tax policies tailored to West Africa. Through presentations, expert panels, and interactive sessions, attendees shared best practices, explored innovative approaches, and fostered collaboration with international partners like the

World Health Organization (WHO) and

ECOWAS.