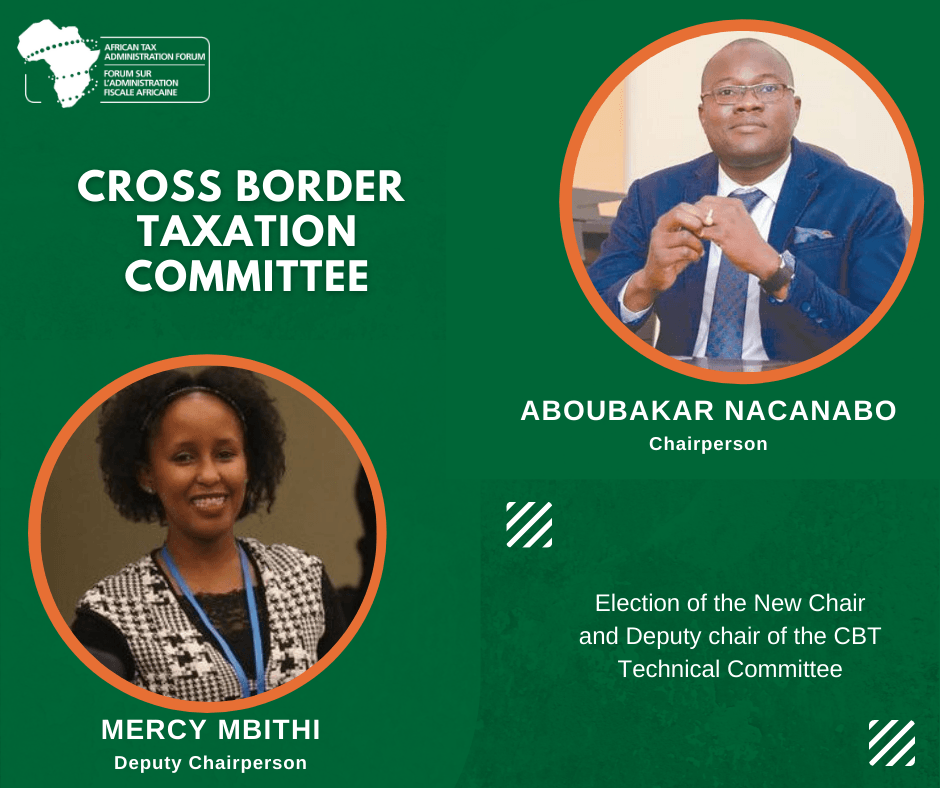

Aboubakar Nacanabo and Mercy Mbithi: Meet the new Leadership of the CBT Technical Committee

PRETORIA - The Cross Border Taxation (CBT) has elected a new Chairperson and a Deputy.

Mr Aboubakar Nacanabo from Burkina Faso has been elected as chairperson, and Ms Mercy Mbithi from Kenya was appointed the deputy. The election took place during the 25th meeting of the CBT Technical Meeting on Wednesday, 5 August 2021, which was held virtually.

The CBT has been in existence since 2014 and is made up of 10 countries.

WHAT YOU NEED TO KNOW ABOUT MR NACAMABO

Mr Nacanabo joined the CBT in 2014, and he is the Head of the Tax Audit Unit in the Large Tax Office of the Direction Générale des Imports du Burkina Faso. He’s fluent in English and French.

His Technical areas of expertise are:

- Transfer pricing

- Interest deductibility

- Digital economy

In addition to his expertise, the new CBT chairperson also has a PhD in Taxation of the Digitalised Economy from Académiee sciences de management Paris.

WHAT YOU NEED TO KNOW ABOUT MS MBITHI

Ms Mbithi has been in CBT since 2018, and she is currently a Transfer Pricing Auditor with the Kenya Revenue Authority and an adjunct lecturer at Strathmore Law School.

Her area of expertise includes:

- Transfer pricing

- Permanent establishments

- VAT on cross border transactions

In addition to the expertise, Ms Mbithi was a top student in the Executive Masters in Taxation.

The aim of CBT is to give ATAF Members technical analysis of standard-setting processes and gather inputs from members on the direction the Secretariat should take.

The CBT also produces technical papers such as the seven technical note series developed to guide African countries in the taxation of the digitalised economy. The CBT has also developed various guidelines and suggested approaches to drafting legislation such as transfer pricing and interest deductibility.

Among some of the tasks the new leadership will be undertaking include the technical design input to the Pillar One and Pillar Two Proposals, the United Nations Article 12B and supporting technical assistance in ATAF member countries.

Read this article in

French and

Portuguese.