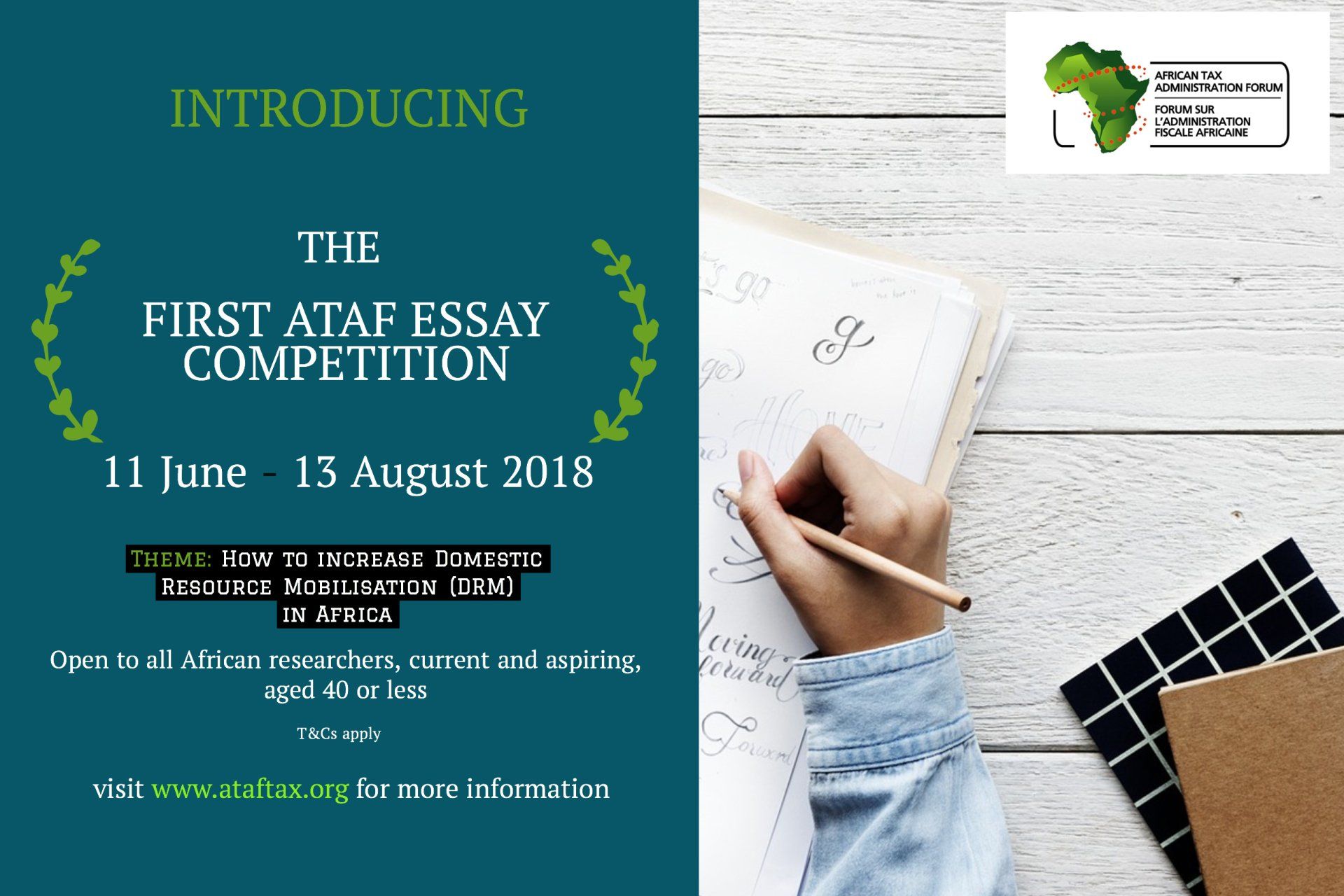

AFRICAN TAX ADMINISTRATION FORUM’S (ATAF) 1ST AFRICA WIDE TAXATION ESSAY COMPETITION (ATEC) 2018

(African solutions for Africa by Africans)

The African Tax Administration Forum (ATAF) is pleased to announce the 1st Africa wide Essay Competition (ATEC) for 2018. The essay competition is designed to encourage young African researchers, academics and tax officials to identify problems or challenges faced by African tax administrations and propose innovative solutions.

ATAF’s Mission

ATAF serves as an African network that aims at improving tax systems in Africa through exchanges, knowledge dissemination, capacity development and active contribution to the regional and global tax agenda. Improved tax systems will increase accountability of the State to its citizens, enhance domestic resource mobilisation and thereby foster inclusive economic growth.

ATAF’s Mandate

In implementing its Mission, ATAF shall:

-

- Improve the capacity of African tax administrations to achieve their revenue objectives;

- Advance the role of taxation in African governance and state building;

- Produce and disseminate knowledge on tax matters to inform policy and legislation formulation, foster transparency and accountability and improve revenue collection;

- Provide a voice for African countries on regional and global platforms and influence the international tax debate; and

- Develop and support partnerships between African countries and development partners.

Theme:

The ATAF 1st Africa wide Essay Competition (ATEC) gives you the opportunity to bring forward your feasible and readily implementable solutions on how African tax administrations can improve their systems, services and revenue collection to increase domestic resource mobilisation and tackle illicit financial flows (IFFs). Essays can also address issues regarding tax policies to help improve tax legislation and systems on the continent. For this year’s competition, participants are required to write on the following topic: How to increase Domestic Resource Mobilisation (DRM) in Africa.

The Addis Ababa Action Agenda highlighted the importance of domestic resource mobilisation for African countries to reach the Sustainable Development Goals (SDGs). Africa’s ability to mobilize domestic resources to fund development hinges on meeting a number of challenges, one of which is enacting well-designed, appropriate tax policies and effective legislation for implementation by the tax administration.

Eligibility

The ATAF 1st ATEC 2018 is open to all African researchers, tax officials, academics and tax practitioners aged 40 or less .

Terms and Conditions

- The Essay must be about the described topic and must conform to the Essay Guidelines below in order to be eligible for the Competition.

- The essay Must be original work of and written by the entrant as its sole creator/author.

- ATAF employees or any official involved in the development, production, implementation, administration, judging or fulfillment of the Competition are not eligible to enter.

- ATAF will reserve the right to publish and disseminate awarded essays.

- ATAF will not be responsible for any breach of copyright or confidentiality by any author

- Winners of the competition will NOT be entitled to represent ATAF in any manner except mention this award in their CV.

- If an author accepts an offer of publication before being notified about the results of this competition, ATAF must be informed immediately.

- ATAF will have the final authority to relax any of the criteria in the larger interests of the profession and research.

- The decision of the Judges on the selection of essays would be final.

- Selection of an essay by ATAF will not mean that ATAF endorses or subscribes to the views expressed by the author.

Essay Format Guidelines - The essay should be original, theme-based and should not have been published elsewhere at the time of submission.

- The length of the essay should NOT exceed 1200 words (Two pages).

- The standard format of the essay is Times New Roman, Font 12, a 1-inch margin on all sides and 1.5 line spacing. Any uniform mode of citation can be followed for footnotes with Times New Roman, Font 10 and 1 line spacing.

- Submitted as an MS Word file only.

- The Essay must be written in English, French or Portuguese.

- Please NOTE that submissions must include two (02) documents:

- The title page should include:

- Article’s Title

- Full Name and Contact details (institution, postal address; telephone number, and email address) of the corresponding/presenting author.

- Full Names and Contact details (institution, postal address; telephone number, and email address) of all co-authors.

- The essay should include (the Essay MUST be anonymous):

- Main text

- Indication of figures and tables with numbering, title and source

- References

- The title page should include:

DEADLINE FOR SUBMISSIONS: 13 August 2018

PRIZES AND AWARDS:

The prizes of the ATAF 1st African wide Tax Essay Competition 2018 (ATEC 2018) will be as follows:

- ATEC 2018 First Prize: The overall best submission receives the ATEC 2018 First Prize of: 1500 USD . The winner will be invited to 4th ATRN Annual Congress to be held from 10 – 12 September 2018 in Morocco, for a special award ceremony with flight and accommodation expenses covered. At the Congress, the winner will be required to make a presentation of the essay.

- ATEC 2018 Second Prize: The Second best submission shall receive a prize money of USD 1000

- ATEC 2018 Third Prize: The Third best submission shall receive a prize money of USD 750

- A ll Participants: All participants will receive an ATEC 2018 participation certificate.

EVALUATION

The ATEC 2018 essays will be evaluated based on the following criteria: (1) depth of research; (2) originality of thought; (3) quality, clarity, and efficiency of presentation; and (4) relevance to African tax administrations. The ATAF reserves the right to award fewer or lesser prizes (or no prizes at all) if the judges determine that all submissions (or insufficient submissions) do not merit selection.

NOTIFICATION:

Entrants will be notified that their Essays have been received within 2 days of submission and will be notified of competition results by 24 August 2018 .

Please NOTE that no Essay submission will be accepted via e-mail . Only successful submissions will be notified. All Submissions must be made via the following link: https://www.123formbuilder.com/form-3824574/

Please do not include any identifying information in the Essay

For any further queries, please contact:

Mr Eugénio Brás at e-mail: ebras@ataftax.org or alternatively at: +27 12 451 8810/+27 (0) 63 689 3894

Dr Nara Monkam at e-mail: nmonkam@ataftax.org