STRATEGIC GUIDELINES

ABOUT

STRATEGIC GUIDLINES

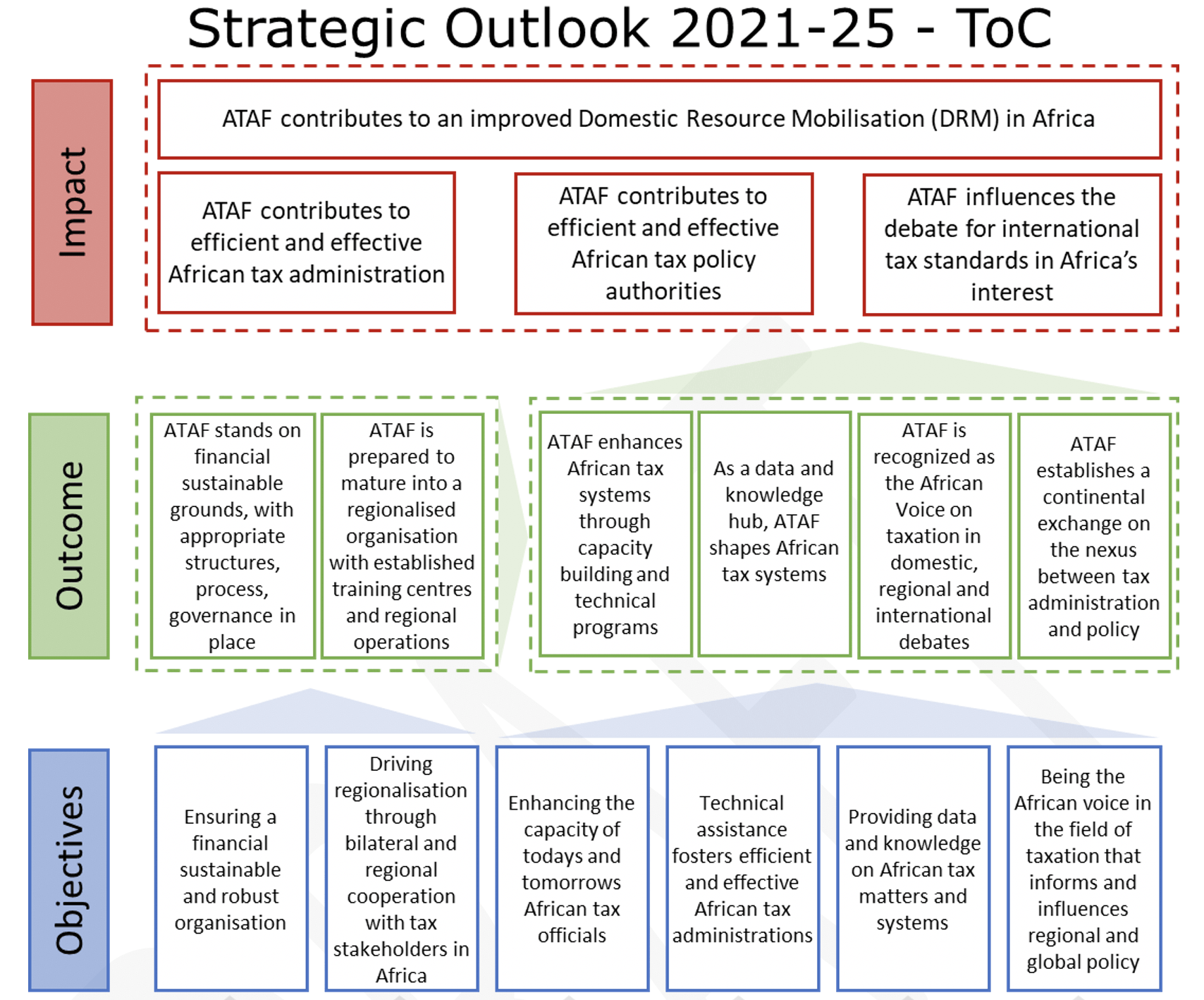

Strategic Plan

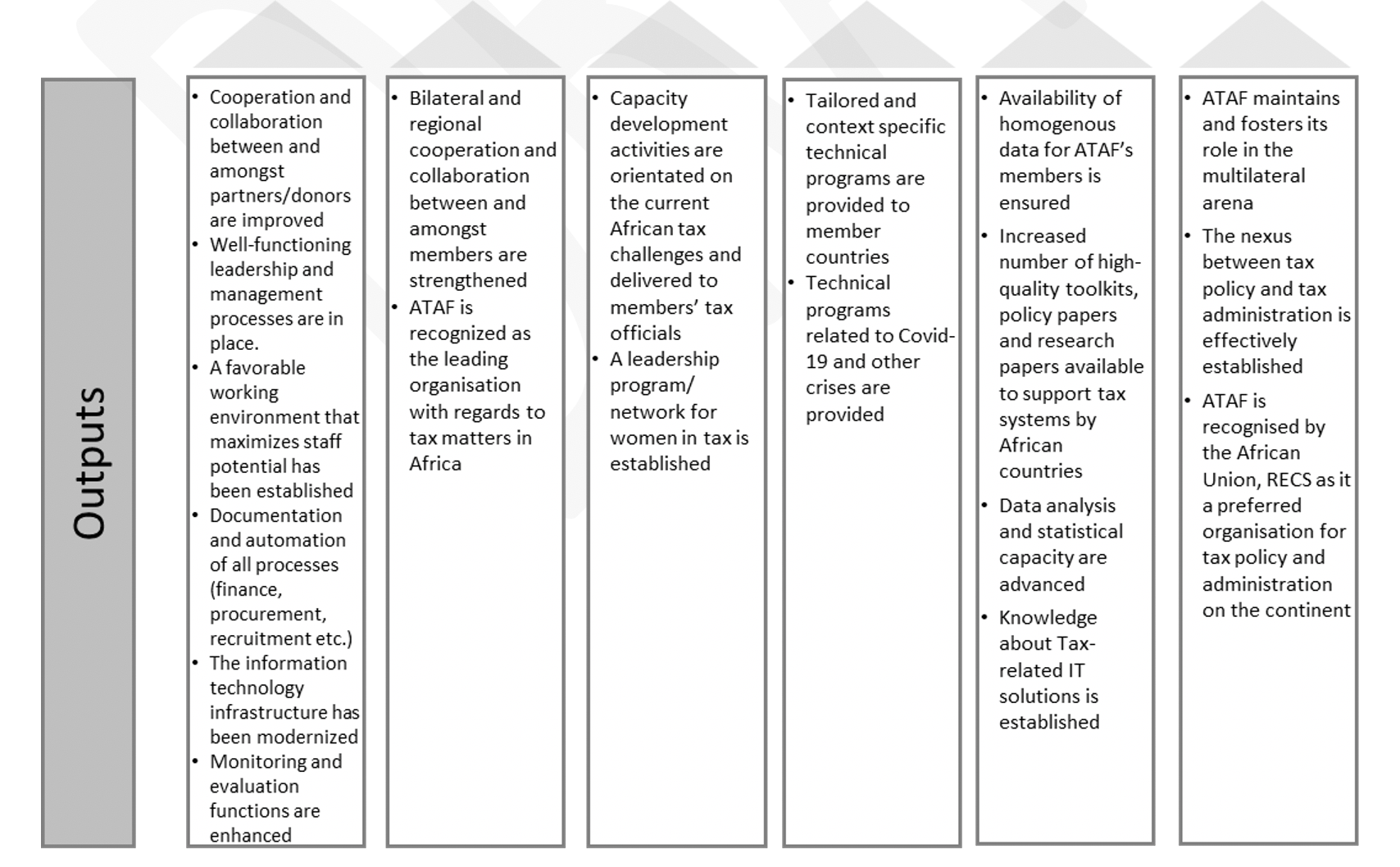

ATAF will also foster relationships with its various development partners and donors to enhance the cooperation and collaboration with its partners and donors and to ensure long term financial sustainability of the organisation. The following six outputs aim to ensure that ATAF develops as an organisation with financial sustainable and robust processes in place.

- Objective I – Ensuring a financial sustainable and robust organisation

- Objective II - Driving regionalisation through bilateral and regional cooperation with tax stakeholders in Africa

- Objective III – Enhancing the capacity of todays and tomorrows African tax officials

- Objective IV – Technical assistance fosters efficient and effective African tax administrations

- Objective V – Providing data and knowledge on African tax matters and systems

- Objective VI – Being the African voice in the field of taxation that informs and influences regional and global policy

Mandate

In implementing its mission, ATAF shall:

- Improve the capacity of African tax administrations to achieve their revenue objectives;

- Advance the role of taxation in African governance and state building;

- Produce and disseminate knowledge on tax matters to inform policy and legislation formulation, foster transparency and accountability and improve revenue collection;

- Provide a voice for African countries on regional and global platforms and influence the international tax debate; and

- Develop and support partnerships between African countries and development partners.

With this mandate the organisation aims to:

- contribute to efficient and effective African tax administrations;

- contribute to efficient and effective African policy authorities; and

- influence the international tax debate for standards in Africa’s interest.

ATAF theory of change

CONTACT

14 Hilden Road (off Daventry Road),

Kaaimans Building,

3rd Floor, Lynnwood,

Pretoria, South Africa

Copyright © 2022 African Tax Administration Forum - All Rights Reserved